Table of Contents

Identifying the U.S. Cities with the Most Remote Employees

Recently, we came across a striking visualization from Visual Capitalist that maps where remote workers are concentrated across major U.S. cities. From California to New York, several metro areas still have a significant share of remote workers, even as many employers increase return‑to‑office (RTO) and hybrid expectations.

For employers, this kind of regional insight is more than trivia. It helps you understand what workers expect in specific markets and informs key hiring decisions, like whether to offer hybrid or fully remote options in order to avoid talent attrition and stay competitive. Since helping businesses make informed hiring decisions is at the core of what we do at Corporate Navigators, we consider this data especially worth sharing.

Which City Has The Most Remote Workers?

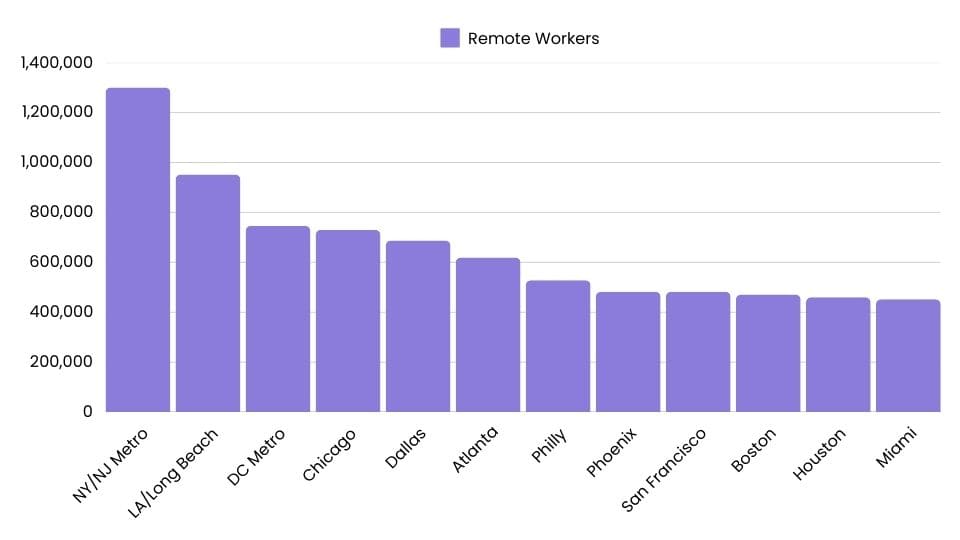

According to the Visual Capitalist data sourced from the U.S. Census Bureau, the New York–Newark–Jersey City metro area has the highest number of remote workers, with about 1.3 million people working from home. Second on the list is the Los Angeles–Long Beach–Anaheim, CA metro area, with approximately 952,000 remote workers. Third is the Washington–Arlington–Alexandria, DC‑VA‑MD‑WV metro area, with about 746,000 remote workers—roughly one‑fifth of the total workforce there.

These numbers highlight a key pattern: some of the country’s largest economic hubs also have the greatest absolute number of remote workers, even if a smaller share of their overall workforce is remote compared to mid‑sized, high‑flex hubs like Austin or Boulder.

The Visual Capitalist Study at a Glance

Overall, this Visual Capitalist analysis underscores how remote work has become deeply embedded in certain metropolitan areas, with cities like San Francisco, New York, Washington, D.C., and Austin seeing substantial numbers or shares of remote workers. The data also shows that employees in these regions are more likely to have flexible arrangements, often in the form of hybrid models that blend office and home days.

Notably, remote workers tend to cluster in higher‑cost coastal and tech‑heavy metros, but there is also a growing presence in lower‑cost regions that attract remote talent with more affordable living and strong quality of life. In other words, remote work is no longer just a big‑city phenomenon—it is a national pattern with local variations.

Remote Work by Metro: Top U.S. Cities

Below is a snapshot of major metros with the largest numbers of remote workers, based on the Visual Capitalist/U.S. Census Bureau data.

| City/Metro Area | # of Remote Workers | % of Workforce |

|---|---|---|

| New York / New Jersey Metro | 1,300,973 | 12.50% |

| Los Angeles–Long Beach | 952,276 | 13.80% |

| Washington–Arlington | 745,855 | 20.70% |

| Chicago Metro Area | 729,953 | 14.40% |

| Dallas–Fort Worth Area | 687,812 | 15.60% |

| Atlanta–Sandy Springs Metro | 609,408 | 17.80% |

| Philadelphia Metro Area | 528,630 | 15.80% |

| Phoenix–Mesa Metro Area | 481,980 | 18.40% |

| San Francisco–Oakland Metro | 481,798 | 19.00% |

| Boston–Cambridge Metro | 470,828 | 16.60% |

| Houston–Pasadena Metro | 459,609 | 11.80% |

| Miami–Fort Lauderdale Metro | 451,688 | 13.80% |

| Seattle–Tacoma–Bellevue Area | 436,144 | 19.00% |

| Minneapolis–St. Paul | 382,847 | 18.20% |

| Denver–Aurora Metro | 377,021 | 21.20% |

| Austin–Round Rock Metro | 339,824 | 23.60% |

| Tampa–St. Petersburg Metro | 314,698 | 18.40% |

| Charlotte–Concord Metro | 310,722 | 20.30% |

| Detroit–Warren–Dearborn Metro | 284,557 | 12.80% |

Remote, Hybrid, and RTO: What the 2026 Landscape Looks Like

While the share of fully remote jobs has dipped slightly since the pandemic peak, remote and hybrid work remain entrenched in many large U.S. cities. Recent reports suggest:

- Roughly one in eight full‑time U.S. employees now works fully remote, while a much larger share works in a hybrid model.

- Hybrid has become the “default” for many remote‑capable jobs, with a majority of companies using some version of a 2–3 day in‑office rhythm.

- Some large employers continue to tighten RTO policies, but employee expectations for flexibility remain high, especially in metro areas where remote work has been common for years.

For talent teams, this means candidates in the metros listed above are more likely to compare your offer against local norms for flexibility—not just base pay.

Why This Data Matters for Recruiting Strategy

Understanding where remote work is most prevalent across the U.S. is essential for businesses shaping offers and policies. By knowing which cities have the highest concentration of remote workers, companies can tailor compensation, benefits, and work‑model expectations to better align with local norms. When you meet regional expectations, you can improve key outcomes like retention rates, time to fill, and offer acceptance.

For example, in a city like Chicago—with more than 700,000 remote workers—posting an in‑person‑only job may require stronger incentives than in a market where remote options are less common. You might:

- Adjust salary to reflect commuting costs and time

- Offer flexible hours, even if the role is on‑site

- Highlight career growth, culture, and stability to offset reduced flexibility

This kind of data‑driven approach helps you stay competitive, especially when remote‑capable talent can compare offers nationally, not just locally.

Get an Edge Through Competitive Intelligence

The Visual Capitalist study is just one example of how deeper insight into remote work and regional labor trends can support smarter hiring decisions. When you understand where remote workers are, how hybrid norms differ by city, and what competitors are offering, you can design roles and packages that resonate with the talent you want most.

If you are looking to gain deeper insight into market trends, competitor offerings, or location‑specific expectations, our competitive intelligence services can help. We gather and synthesize the data you need—whether you are refining your hiring strategy, adjusting your return‑to‑office plan, or enhancing employee offerings—so you can make informed decisions and stay ahead in a shifting, hybrid‑first talent market.gs, we can provide the data-driven insights you need to make informed decisions and drive success.